Do petrol prices need to fall substantially further?

Today on Breakfast Paul Henry was stating that petrol prices are far too high, given that crude oil has fallen to $40US a barrel. His criticism was that the retail price of petrol has not fallen at the same rate as crude oil – of course this wouldn’t make much sense given that there are other cost components to the sale of fuel than just the price of crude oil. However, I was wondering if his criticism that prices were “too high” had any merit.

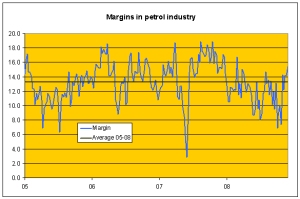

Now, I don’t have any data, or any analysis to fall back on, when looking at whether the price of petrol is “fair”. However, MED does do some work on fuel prices here. Among the statistics they have a “fuel price margin” page, here. This “margin” tells us what residual is left to give to the importers, distributors, and retailers in the petrol market. Lets have a look at the graphs they provide:

So the margin over the last couple of weeks hasn’t moved very much – this seems to indicate that a lot of the fall in costs has been passed on. However, taking a slightly longer term view:

So compared to the rest of the year, margins are now relatively elevated. There are two ways we can take this:

- Petrol companies are increasing margins in the face of a cost decrease,

- Petrol companies are trying to recover margins after a period of cost pressure.

In the first case we may see this as “unfair”, the second case seems “fair”. You can make up your mind by looking at margin data for the past three years:

Seems “fair enough” to me.

Note: These margin figures differ, as they are not adjusted in the same way as the other MED figures – however, I can’t find historicals for the other numbers, so these are just indicative.

Copyright tvhe.wordpress.com ©

Interesting post Matt.

I was talking to someone about this the other day and they were making a similar comment to Paul Henry that fuel prices weren’t dropping even though oil prices were plummeting. My response was that you need to look at what was happening while oil prices were skyrocketing to make any comment about what should happen when they come back down.

Interesting to see the data now since I had no idea what it would show at the time, I was worried that I might have been unjustifiably defending the petrol companies 🙂

Got to love that economists intuition agnitio – you are the resident industrial economist after all 😉