Taking another quick look at petrol prices

So since the last post I’ve thought of a few other things I could do to get an idea of pricing behaviour.

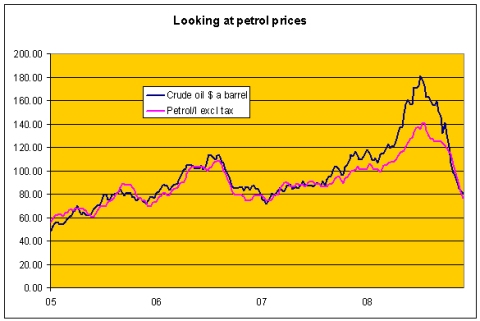

First, lets compare the price of petrol per litre (excluding tax) to the $NZ price per barrel of oil:

Source MED

Source MED

If we run with the idea that “prices should change proportionally” (something I think is wrong) then this isn’t a story of petrol companies extracting additional surplus – it is a story of things going back to normal after a period where fuel companies were being strangled! If prices didn’t increase proportionally, then why the hell should they fall proportionally?

Anyway – lets dig a bit more. First let us just run a simple linear regression between petrol prices and the price of crude oil for the April 2004 – June 2007 period. This tells us that, over this period, if the price (excluding tax) was only a function of crude oil and the relationship was linear and only contemporaneous the petrol price (ex tax) = $22.8072 + $0.717692 x crude oil. Now these assumptions are rubbish – but it is an interesting starting point (and it is where I’m going to leave it because of time constraints).

Given this, we can “forecast” what petrol prices should have been, given the current value of crude, over the period July 2007 – November 2008:

So the price undershot when crude oil rose, and after briefly rising above where it should be it is now below the forecast again. As a result, if we believe that fuel companies were sufficiently competitive in June 2007, this suggests that they are now.

I wouldn’t take this as comprehensive evidence – especially given that the methods used are as basic as could be, and given the fact that I haven’t tried a number of other, important, explanatory variables. However, it increases my belief that the petrol companies aren’t “screwing us over” by co-operating and taking advantage of the fact that market demand is inelastic.

Copyright tvhe.wordpress.com ©

Trackbacks & Pingbacks

[…] Taking another quick look at petrol prices | TVHE […]

[…] mentioning of “oil companies” was slightly off the mark – given that they have slashed prices in the face of falling crude oil (although to be fair the Bank was just asking them to keep going – […]

Comments are closed.